By NEIL HARTNELL

Island Luck’s attorney yesterday warned that the web shop tax hikes place The Bahamas “in clear and present danger” of violating the European Union’s (EU) anti-tax evasion offensive.

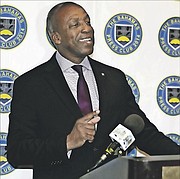

Alfred Sears QC, pictured, in a statement issued last night, said the Bahamian gaming industry was “a classic case of ring fencing” due to the preferential tax breaks/concessions granted to foreign-owned casinos compared to the domestic web shop industry.

Contrasting the sector’s treatment with the speed with which the Government last week moved to eliminate so-called “ring fencing” in the financial services industry, Mr Sears argued that the new and increased web shop taxation will “only compound” the same issue in the gaming industry by “widening the gap” between local operators and casinos.

He warned that “this contradiction in government’s tax policy” threatened to expose The Bahamas to further sanctions by the 28-member EU bloc, in addition to continued litigation by the web shop operators themselves, unless the Minnis administration reversed course and addressed the matter.

Mr Sears’ warning came as he hit out at Carl Bethel QC, the attorney general, for negotiating through the media with himself and his client. Mr Bethel told Tribune Business on Friday that he had “rejected” Island Luck’s counter-proposal to resolve its taxation dispute with the Government – something the web shop chain had to learn via this newspaper.

However, Mr Sears argued that he and his client had never “received any substantive written response” from Mr Bethel despite submitting three settlement proposals over a two-month period – on October 26, 2018; November 13, 2018; and December 24, 2018.

The Government, he added, agreed on August 31, 2018, to “stay” implementation of both the “sliding scale” structure and five percent “patron tax” imposed in the 2018-2019 Budget to engage “in good faith negotiations” with the web shop industry to resolve their dispute out of court – something Mr Sears suggested was not happening.

However, Mr Sears’ argument that The Bahamas is in violation of the EU’s demands to end “ring fencing” as a result of its gaming industry policies is likely to gain the most attention, especially since the EU will determine on Friday which jurisdictions to “blacklist” as non-cooperative.

He contrasted the Government’s eagerness to bring the financial services industry into compliance with Mr Bethel’s assertion about “going to war” to “protect the new, discriminatory gaming tax regime and put The Bahamas at further risk of being sanctioned for affording preferential treatment to foreign enterprises in the gaming sector”.

With The Bahamas now “blacklisted” by The Netherlands for having a “no or low corporate tax rate below 9 percent”, Mr Sears said this nation was exposed to similar action by other individual EU countries on the same basis via the bloc’s Anti-Tax Avoidance Directive.

He added that, just like the banks, insurance companies and securities players accommodated by the Government last week, the entire gaming industry – casinos and web shops – were also treated as financial institutions for the purposes of anti-money laundering legislation.

“While certain financial institutions, such as banks, insurance, trust and international business companies, are afforded the opportunity to engage in broad consultation with the Government, guided by global standards, mutual respect and the principle of a levelled playing field, Bahamian gaming house operators have not been given the same consideration,” Mr Sears argued.

“The Government, through its current proposals to increase the tax rate on gaming house operators up to 400 percent, will deepen preferential treatment of – and the ring-fencing around – casinos owned by foreign companies, some of whose shareholders are citizens in OECD member countries, and will likely increase channelisation of patrons into the unregulated gaming market, thus increasing the risk of international sanctions against The Bahamas.”

He added: “Recklessly, the Government proposes to increase the tax rate on gaming house operators by a sliding scale from 20 percent up to 50 percent, plus a five percent Stamp Tax on patrons’ deposits. However, the rate of tax on casinos will remain the same.

“This preferential low tax treatment of foreign-owned casinos relative to the excessively high tax treatment of Bahamian-owned gaming house operators is an unfair, inequitable and indefensible tax treatment of entities in the same sector.

“This disparate tax treatment is a classic case of ring-fencing, defined by the European Union’s Anti-Tax Avoidance Directive as low-tax jurisdiction for foreign operators in the same sector with a statutory tax rate of 7 percent or less or jurisdictions that have been listed by the EU as a non-cooperative jurisdiction.”

As a result, Mr Sears said the Governments efforts to eliminate “ring fencing” in financial services “should apply equally to the ring-fencing that exists in the gaming sector, which represents a clear and present danger for The Bahamas.

“Why should we wait for another negative listing by the EU, its member countries or other multilateral bodies before we address this discriminatory, unfair, inequitable and indefensible disparate tax treatment of entities within the same gaming sector?,” he added.

“By aggressively pursuing the exorbitant ‘sliding scale’ taxation structure on the domestic gaming industry while widening the gap between domestic and foreign gaming operators, the Attorney General is only compounding the ring fencing in the gaming sector that the Minister of Finance is seeking to eliminate between foreign-owned financial institutions, such as banks, trust companies and IBCs. This contradiction in Government’s tax policy will expose The Bahamas to continuing punitive sanctions as a low-tax jurisdiction and litigation by Bahamian gaming house operators.”

Speaking to Tribune Business, Mr Sears said hotel-based casinos at Atlantis and Baha Mar also received significant taxpayer subsidies – unlike their web shop counterparts – given that they were seen as critical tourist attractions and foreign exchange earners.

“How could you logically say preferential treatment of banks and IBCs, which are financial institutions, have to be removed and create a level plying field, but not appreciate casinos and gaming houses are financial institutions?” he queried.

“The same arguments are that casinos, owned by by taxpayers resident in their member countries, are being lured by low tax jurisdictions as a result of preferential, ring fenced tax regimes which the locals do not have access to. Is this not the same argument being applied to IBCs, banks, trust and insurance companies? I must be missing something in this whole scenario.”

The web shops’ case is based on what they allege is the lack of due process afforded to the industry over its introduction, and they view its new and increased rates as arbitrary, punitive and discriminatory.

Under this structure, web shops pay on each portion of their revenue:

• Up to $20 million in revenue, a rate of 20 per cent.

• Between $20 million and $40 million, a rate of 25 per cent.

• Between $40 million and $60 million, a rate of 30 per cent.

• Between $60 million and $80 million, a rate of 35 per cent.

• Between $80 million and $100 million, a rate of 40 per cent.

• Over $100 million, a rate of 50 per cent.

Five out of seven web shop operators fell solely in the lowest 20 percent category, while for a sixth, only a small portion of its revenue fell into the 25 percent category. Only Island Luck, the market leader, whose revenues will attract all tax rates.

The web shop industry and its consultants have also argued that The Bahamas is unique in levying a tax directly on patrons as opposed to the gaming house operators. However, the Government believes this is necessary to tackle the social ills caused by excessive gambling and help deter the industry’s growth.

Mr Sears, responding to Mr Bethel, said it was “curious” that the Attorney General was both negotiating through the media and not disclosing that he had been asked not to make “intemperate statements” about their talks.

“Playtech [Island Luck’s parent] has sought to engage the Attorney General in good faith settlement negotiations,” Mr Sears added. “We have sent a number of written settlement proposals to the Attorney General, supported by opinions of leading international gaming experts, on December 24, 2018; November 13, 2018; October 26, 2018.

“We have not received any substantive written response from, serious consideration of or engagement by the Attorney General on our clients’ settlement proposals. Rather than negotiating in good faith with gaming house operators, consistent with the undertaking that he gave to the Supreme Court, the Attorney General seems committed to deepening this unfair, inequitable and preferential tax treatment of entities in the same sector.

“There are grave interests at stake in this matter, with profound implications for the public revenue, the sustainability of Bahamian-owned gaming enterprises and the security of over 3,000 full-time jobs of Bahamian citizens which require our careful and fair conduct.”

Mr Sears told Tribune Business that Island Luck had hired multiple international gaming experts, all of whom had made written submissions, but the web shop had “not gotten one written response addressing anything we have put forward”.

He added: “We got an expert who said this was the only jurisdiction where you have a tax on customer deposits before any consumption. When you have a patron tax it’s usually on the winnings after the consumption.”